IRS Mandates Electronic Filing of 990 Returns for Tax-Exempt Organizations. E-File Now

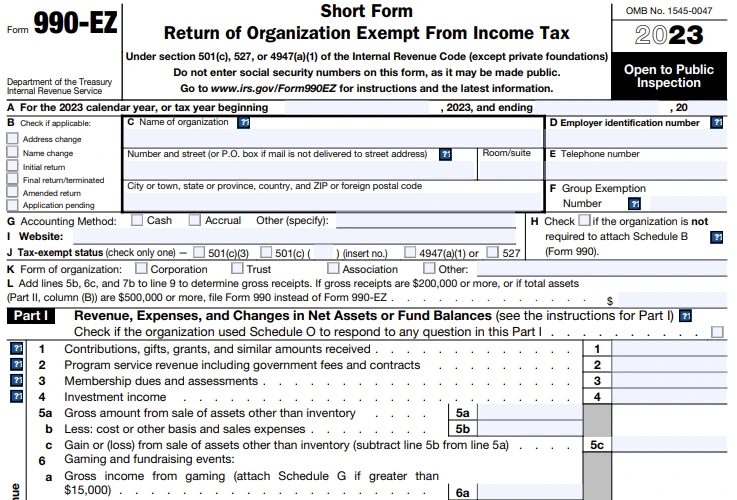

Form 990-EZ Filing Requirements

- Basic Organization details - Name, EIN, Phone Number, Address, and more.

- Revenue - Contributions, gifts, & grants, Interest received from an

investment and more - Expenses - Salaries, legal fees, accounting fees, travel costs, and more

- Assets - Investments, land, buildings, and equipment

- Activities - Political, unrelated business, lobbying and more

-

Officer details - Name, address, compensation, average working hours

and more - Program Service Accomplishments - during the tax year

Visit https://www.expresstaxexempt.com/form-990-ez/form-990-ez-instructions/ to know more about the information required to file form 990-EZ.

How to File Form 990-EZ Electronically?

To e-file Form 990-EZ with Tax 990, follow the below simple steps below:

Step 1

Step 2

Step 3

Step 4

Step 5

How to File Form 990-EZ Electronically?

To e-file Form 990-EZ with Tax 990, follow the below simple steps below:

Step 1

Step 2

Step 3

Step 4

Step 5

Why E-file Form 990-EZ with Express990?

Loaded with extraordinary features, our software offers you a comprehensive e-filing solution to file your Form 990-EZ smoothly and securely.

Simple preparation process

We have Form-Based and Interview-Style filing options to make your form preparation as easy as possible.

Internal Audit Checks

To ensure there are no IRS errors in your Form 990-EZ, we have an Internal Audit Check to review the form.

Copy Data From Prior Year Return

If you have filed with us previously, you can copy certain information to your IRS Form 990-EZ from your prior year returns.

Access your copy at any time

Our software stores your form copies safely in cloud storage and you can access them anytime if required.

Customer Testimonials

Pricing

- Includes 990-EZ Schedules

- No Subscription Fee

- Pay only for the return you file

- Discounted Pricing for the Tax Professionals

- Live support via chat, mail, and phone

Frequently Asked Questions on

Form 990-EZ

Who needs to file Form 990-EZ?

The organizations exempt from income tax under Section 501(a) need to file a nonprofit tax return.

Form 990-EZ is filed by organizations with gross receipts less than $200,000 and total assets less than $500,000.

Click here to learn more about Form 990-EZ filing instructions.

When is the due date to file Form 990-EZ?

The due date to file form 990-EZ is the 15th day of the 5th month after the organization's accounting period ends.

Note - If the due date falls on a Saturday, Sunday, or any legal holiday, file the form on the next business day.

What are Form 990-EZ Schedules?

There are 8 Schedules available for Form 990-EZ, which may be attached by the filing organizations based on the activities they performed:

- Schedule A - Public Charity Status and Public Support

- Schedule B - Schedule of Contributors

- Schedule C - Political Campaign and Lobbying Activities

- Schedule E - Schools

- Schedule G - Supplemental Information Regarding Fundraising or Gaming Activities

- Schedule L - Transactions with Interested Persons

- Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

- Schedule O - Supplemental Information

Click Here to know 990-EZ Schedules in detail.

How do I get more time to file IRS Form 990-EZ?

If your exempt organization needs more time to file Form 990-EZ online, you can file Form 8868 to request an additional six months.

Organizations must request an extension on or before the Form 990-EZ deadline. We also support the e-filing of Form 8868.

Helpful Resources

What is Form 990-EZ?

Form 990-EZ Instructions