IRS Mandates Electronic Filing of 990 Returns for Tax-Exempt Organizations.

E-File Now

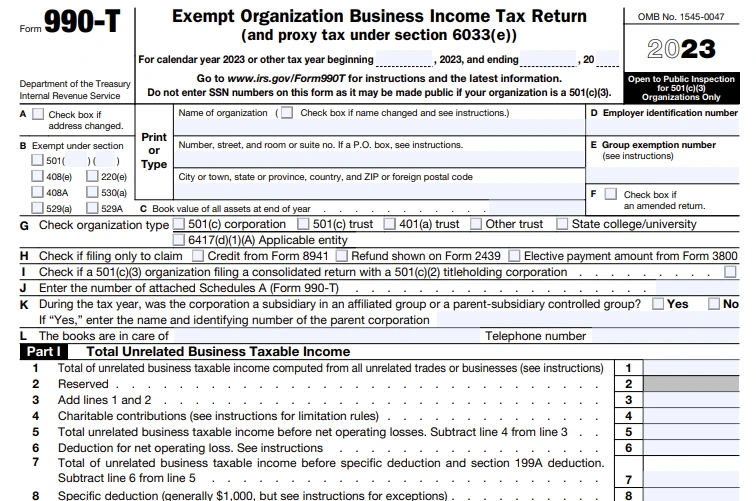

Form 990-T Filing Requirements

The information required to be reported on Form 990-T includes:

- Total Unrelated Business Taxable Income

- Tax and Payments

- Details about certain other activities

Visit https://www.expresstaxexempt.com/form-990-t/form-990-t-instructions/ to learn more about the information required to file 990-T.

How to File Form 990-T Electronically?

To e-file Form 990-T with Tax 990, follow the below simple steps below:

Step 1

Step 2

Step 3

Step 4

Step 5

How to File Form 990-T Electronically?

To e-file Form 990-T with Tax 990, follow the below simple steps below:

Step 1

Step 2

Step 3

Step 4

Step 5

Why E-file Form 990-T with Express990?

Simple preparation process

Our form-based filing method allows users to prepare their IRS Form 990-T easily by entering information directly onto their form.

Internal Audit Checks

To ensure error-free returns, our internal audit check reviews your form and alerts you of any IRS instruction errors before transmission.

Copy Data From Prior Year Return

If you have filed with us previously, you can import certain information from the prior year's returns to the current return.

Access your copy at any time

If you have filed with us previously, you can import certain information from the prior year's returns to the current return.

Customer Testimonials

PRICING

- Includes 990-T Schedule A

- No Subscription Fee

- Pay only for the return you file

- Discounted Pricing for the Tax Professionals

- Live support via chat, mail, and phone.

Frequently Asked Questions on

Form 990-T

Who needs to file Form 990-T?

A disregarded entity, a domestic or foreign organization exempt under section 501(a), section 529(a), or section 529A(a) that receives $1000 or more of gross income from an unrelated business is required to file Form 990-T along with their 990 series return (Form 990 , 990-EZ , and 990-PF).

Filing IRS Form 990-T is to provide information on Unrelated business taxable income to the IRS. For more information about nonprofit tax filing form 990-T, visit https://www.expresstaxexempt.com/e-file-form-990-t/.

When is the due date to file Form 990-T?

The due date for filing Form 990-T with the IRS varies based on the 501(c)(3) tax filing organization’s accounting period.

| Type of Organization | Deadline |

|---|---|

| Employees' trusts, defined in section 401(a), IRAs (including SEPs and SIMPLEs), Roth IRAs, Coverdell ESAs, or 408(a) (Archer MSAs) | 15th day of the 4th month after the end of the tax year. |

| Other Organizations | 15th day of the 5th month after the end of the tax year. |

What are Form 990-T Schedules?

Form 990-T Schedule A is a default statement attached to Form 990-T. If the organization engages in more than one unrelated trade or business, it must complete and attach the required number of Schedule A forms to report income and allowable deduction for each unrelated trade or business.

Click here to learn about

IRS Form 990-T Schedule A in detail.

How do I get more time to file IRS Form 990-T?

If your organization needs additional time to file Form 990-T online, you can request an automatic extension of time using Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return.

Note - Even if you request an extension with Form 8868, you will still need to pay any taxes due in full by the return’s original due date..

Click here to learn more about 501(c)(3) tax returns and reporting requirements.